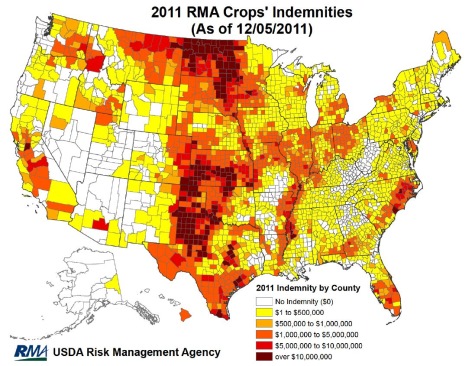

$7.1 B and Counting: Indemnities Soar In 2011

Crop insurance companies have paid out more than $7.1 billion and climbing in claims so far this year, which makes 2011 second only to 2008’s $8.6 billion in the total value of indemnities paid out to farmers. The combination of several large-scale floods in the Central U.S., record droughts in the southern plains, a strong […]

Keeping Crop Insurance Strong

The 2012 budget will likely include modifications and reductions to farm policy. Policy makers should consider 12 essential strengths that make crop insurance the cornerstone of the farm safety net programs. We’ll introduce one strength of crop insurance per month and explain how the sum of these strengths has given us the successful program we […]