30 Years In and Still Reforming – New Keep America Growing Podcast Episode

Did you know that 2024 marks the 30-year anniversary of the 1994 Crop Insurance Reform Act? This means crop insurance has been expanding and adapting to the risk management needs of U.S. agriculture for three decades now. Given this important 30-year anniversary, National Crop Insurance Services (NCIS) and its president, Tom Zacharias, took some time […]

NEW PODCAST EPISODE 🌱 Key Crop Insurance Date in March

Spring is the season of new beginnings, bringing warmer weather and sunshine, and college hoops and March Madness! It’s also the time for farmers to decide which spring crops they want to insure for the 2024 crop year. This is a critical decision for farmers because growing the most abundant and inexpensive food supply in […]

New Podcast Episode: Keep America Growing

NEW PODCAST EPISODE 🌱 Keep America Growing When you think of agriculture and farming in America, what immediately comes to mind? For many, it’s the rolling corn and soybean fields in the Midwest. But America’s farmers grow many different types of fruits and vegetables throughout the country, requiring a diverse crop insurance program that meets […]

New Voter Polling Confirms Importance of Strong Crop Insurance Program

Registered voters support farmers and the protection provided by the crop insurance program, according to recently released data from National Crop Insurance Services (NCIS). American voters are asking Congress to support family farmers by passing a Farm Bill that protects, preserves, and improves crop insurance. A national poll of more than 1,100 registered voters conducted […]

New Podcast: Keep America Growing

Crop insurance is one of the most instrumental components of a strong farm safety net. But with terms like “Actuarial Soundness” or “Whole-Farm Revenue Protection,” it might sometimes feel like you need to be an insurance whiz to fully understand how this public-private partnership works. To keep you up-to-date and in-the-know about crop insurance, National […]

NCIS Scholarship Program Helps Deserving Students

The crop insurance industry is actively working to increase the diversity in its workforce to reflect the diversity of the farmers it serves, and National Crop Insurance Services (NCIS) is proud to be part of this effort by supporting deserving students at the historically Black 1890 Land-Grant Institutions. For more than a decade, NCIS has […]

Crop Insurance is the Cornerstone of the Farm Safety Net

Crop insurance serves America’s farmers and ranchers through effective risk management tools that strengthen the economic stability of agricultural producers and their rural communities. This ensures Americans have access to a safe and secure food supply. Because it protects all American farming operations—no matter the size—it’s an incredibly diverse and robust program. Don’t believe us? […]

Misleading Claims About Crop Insurance Hurt Family Farmers

Farmers don’t profit from crop insurance. They’d rather grow a crop than file a claim. Crop insurance keeps America’s farmers growing after disaster. It’s the cornerstone of the farm safety net, and an integral risk management tool for family farmers. But activist critics are not afraid to use misleading claims to dismantle the farm safety […]

Private-Sector Delivery Protects Farmers

The Federal crop insurance program is built on a unique public-private partnership. Under this successful model, farmers purchase a personalized crop insurance policy from any of the private insurance companies – known as Approved Insurance Providers, or AIPs – authorized to sell and service crop insurance by the U.S. Department of Agriculture (USDA). But how […]

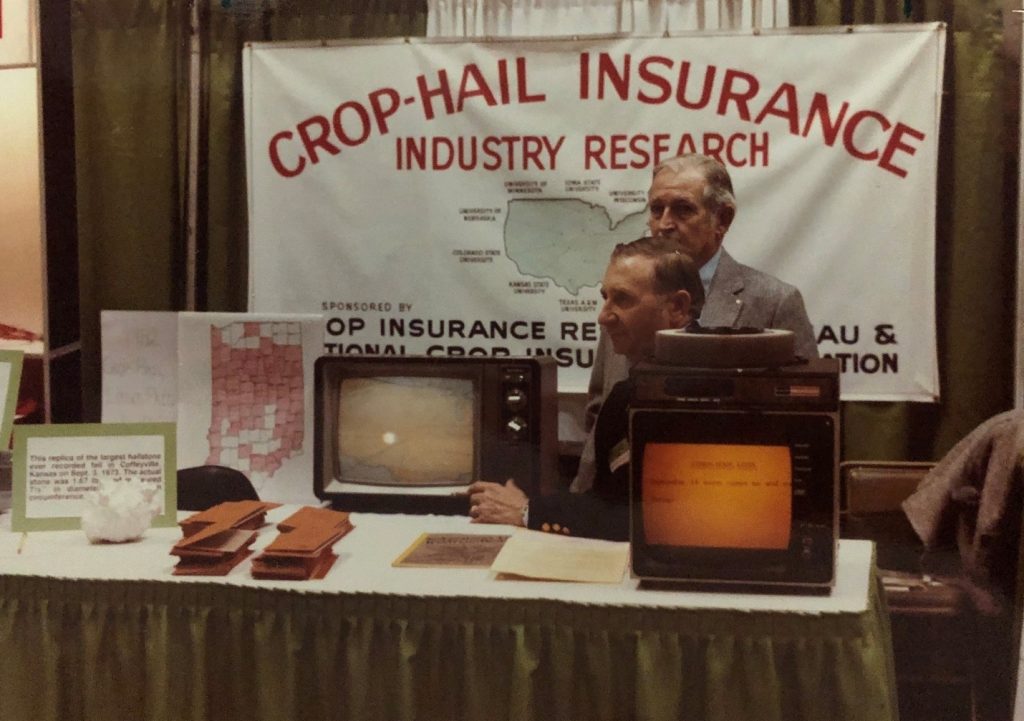

Celebrating 100 Years of Crop Insurance Research

Did you know this year marks 100 years of crop insurance-sponsored agricultural research? That’s right – crop insurance has supported American farmers for the last century, helping them manage risk and overcome obstacles, keeping our food supply safe and secure. In fact, over the past 100 years, National Crop Insurance Services (NCIS) and its predecessor […]